German Church Tax is almost as controversial as the much-hated Rundfunkbeitrag public TV tax.

From the outside, most people would consider Germany to be a broadly non-religious, modern, secular state. However, the reality is that even though the number of active members of the church, especially amongst the younger generation, continues to decline, the church and state are very much intertwined.

How do I avoid paying German church tax and what are the consequences?

In Germany, both the Protestant and Catholic churches, as well as Jewish denominations, are legally empowered to collect taxes from their members. This is administered by the Finanzamt, which in turn takes a small administration fee from the moneys collected.

How is it collected?

If you are a regular, salaried employee, German Church Tax, or Kirchensteuer, is collected through the standard pay-as-you-earn income tax model. It will just show up as a separate line item on your monthly payslip.

For the self-employed, it’s just another tax which has to be factored in when you are building up a provision for your quarterly tax bill. If you employ the services of a tax accountant (Steuerberater), they will advise you how much to hold back.

Church Tax is not administered on businesses. Here there is a whole different slew of tax code which is applicable.

How much is it?

This varies per Federal State. In Bayern and Baden-Württemberg it comes in at 8% of income tax paid. For all other Bundesländer it is 9%.

To work out how much Church Tax you would pay as part of your monthly or annual gross salary, this calculator is a very useful resource. Bear in mind that this tool takes into account the Freibetrag threshold you are entitled to earn before income tax kicks in.

If you want to work out your net salary from your gross, then we put together a handy video explaining step-by-step how to do this. There are a lot of variables which go into calculating this…whether you pay church tax is just one of them!

Arguments for and against the tax

The key argument for keeping the tax is that only those who explicitly wish to are funding the church, as well as any of its associated charitable and business activities. In doing so, the church in theory is not dependent upon gaining funding through other charitable means and the possible influence this could convey.

Church Tax is controversial because, by allowing the church to collect taxation from its citizens through the official state apparatus, Germany’s government cannot exactly maintain a position of neutrality in all matters where the church has a strong viewpoint and active political lobby. The debate around Sunday being a day of rest (Ruhetag) is possibly the most obvious example of this.

A dying tradition

Religious congregations are declining in Germany and have been for some time. Both the Roman Catholic (römisch-katholisch) and Protestant (evangelisch) churches are seeing this trend. This has also impacted the number of people actively paying Church Tax.

According to the website Kirchenaustritt, which provides information and advice (in German only) around how to officially rescind your religious denomination in Germany, over 3.2 million people have formally left the church in the 10 years up to and including 2016.

This, along with more and more babies who are not being baptised, as well as migration into Germany from predominantly non-Christian countries, has reduced the number of officially registered Christians from 50.8 million in 2006 to 45.5 million in 2016, according to the statistics provided by Kirchenaustritt on their website.

Avoid it at Your Anmeldung!

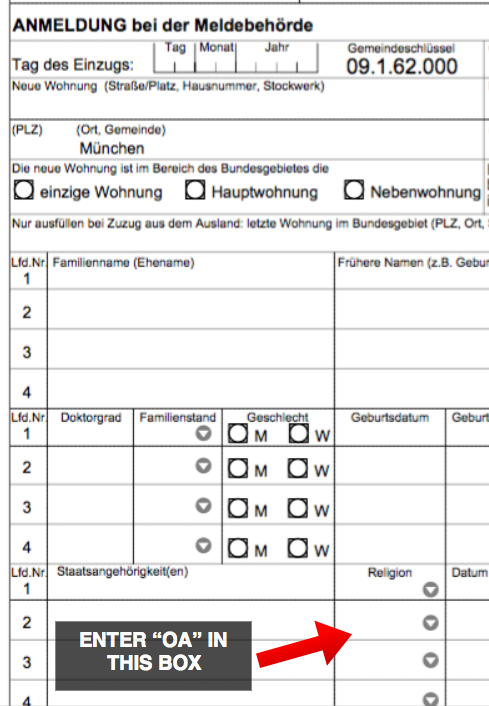

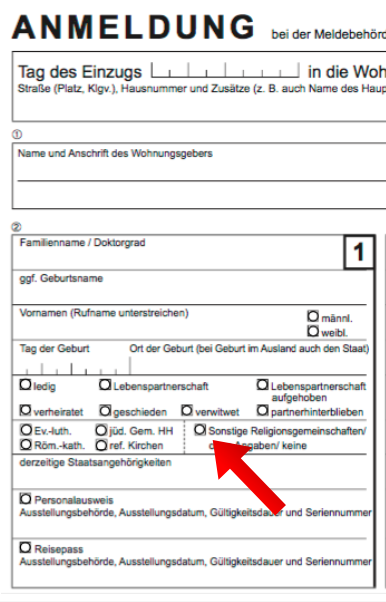

For expats who are moving to Germany, it is vital that you are absolutely sure what you are entering on the form you fill out during the registration (Anmeldung) process at your local municipality Bürgeramt (citizens’ office).

If you do not wish to pay German Church Tax, then you MUST NOT declare your religious domination in the section which asks you for your religion. Note that this only applies to Christians and Jews. Other faiths, aside from one denomination of Islam in Hesse which has taken advantage of this opportunity, are not funded through this means.

Two examples of the form are pictured below (one is for Hamburg, the other for Munich), which show the section and which box to check or code to enter to declare no religious denomination:

Opting out at a later stage

That’s fine, you say. But what if you didn’t know this when you registered and have been subjected to paying German Church Tax, even though you are a non-practising member of your faith.

First of all, the good news is that you can opt out of the system, formally rescind your denominaton of Christianity (or Judaism) and from that point on, Church Tax will no longer be deducted from your monthly salary.

The not so good news is that, like most things in Germany which require any kind of interaction with officialdom, the process is unnecessarily bureaucratic.

Having said that, it does not cost much (typically around €30, depending on Bundesland), and it is well worth doing if you wish to increase your level of disposable income for what is relatively little effort, when compared with other options to improve your finances. Put it this way, it’s a lot easier than applying for a new job in order to get a comparable raise!

The process and cost varies slightly depending on the Federal State. Again, the Kirchenaustritt website is a great resource, although only the very basic information is summarised in English, along with a few other languages.

Depending upon where you live, the process usually involves a visit to a registry office (Standesamt), citizens’ office (Bürgeramt) i.e. where you did your Anmeldung, or local court (Amtsgericht).

You will need to bring your passport and a Meldebescheinigung which is less than 6 months old. Those who are married also have to bring along their marriage certificate.

You will receive an official piece of paper declaring your exit from the church (Kirchenaustritt). Keep hold of this as proof. It should not be necessary to inform your local Finanzamt or your employer, thanks to the electronic ELSTER process which does this automatically.

Extreme cases

A word of caution must be given here that there have been reported cases of extreme profiteering by the church.

Foreigners who have declared “no religion” on their Anmeldeformular during registration have been subsequently targeted by the Kirchensteuerstelle, predominantly in Berlin, and been asked to prove that they are not part of their Christian denomination in their home country.

This seems to be typical for foreign nationals coming from traditionally more religious, and predominantly countries. There is a very long thread on this subject of this on the Toytown Germany forum, if you have the patience to filter through all of the mud slinging and arguments in amongst the nuggets of useful, factual information shared on the thread.

The logic basically goes something like this:

Germany’s tax system i.e. the Finanzamt, which collects Church Tax on behalf of the Protestant and Catholic Churches, does not formally recognise non-practising Christians. Tax law is notoriously black or white. You are either part of the church, or you are not.

For Germans, this is fair enough because everybody knows and understands the system, and there is a mechanism in Germany to support this, as explained above, whereby an individual can formally leave the church.

For foreigners, there is not such a system in their home country, so a non-practising Christian cannot formally rescind his or her membership of their religious denomination. What this means is there is a perfectly legal mechanism for the church to opportunistically exploit non-practising Christians who have arrived as foreign nationals to live in Germany, declared no religion for their Anmeldung but have been baptised or confirmed in the church in their home nation.

The only way to be sure of not falling into this trap is to undertake the formal, recognised process of Kirchenaustritt in Germany, as described above. Although that said, a simple Google search does not bring up any cases of this happening outside of Berlin. So not trying to scare you but better to be safe than sorry, eh?

Consequences

So, if you don’t pay Church Tax, or decide to formally leave the church while you are a resident in Germany, what are the consequences?

First and foremost, it does not affect your ability to attend communion. No priest or vicar will ask for your tax statement when you go up to the altar to receive!

The constraints come more around when you want to get married or baptise a child. If you have officially left the church, it is not possible to perform these sacraments in a German church.

According to a completely unscientific straw poll of friends, colleagues and acquaintances who are still members of their denomination and pay Church Tax, this is the main reason why they do not want to declare a Kirchenaustritt. Almost none of them are regularly practising Christians, but they value the opportunity of a church wedding and to have their children baptised.